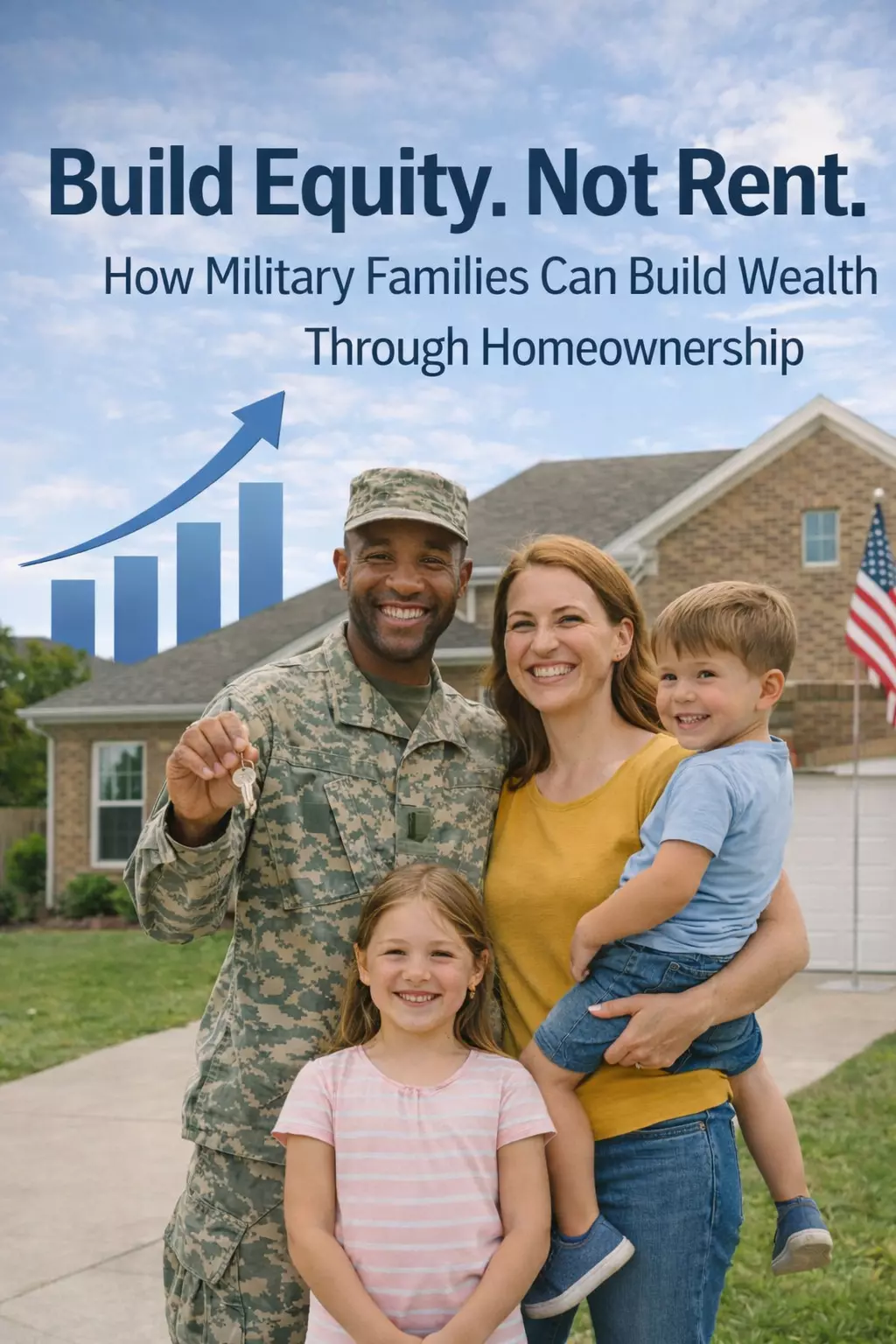

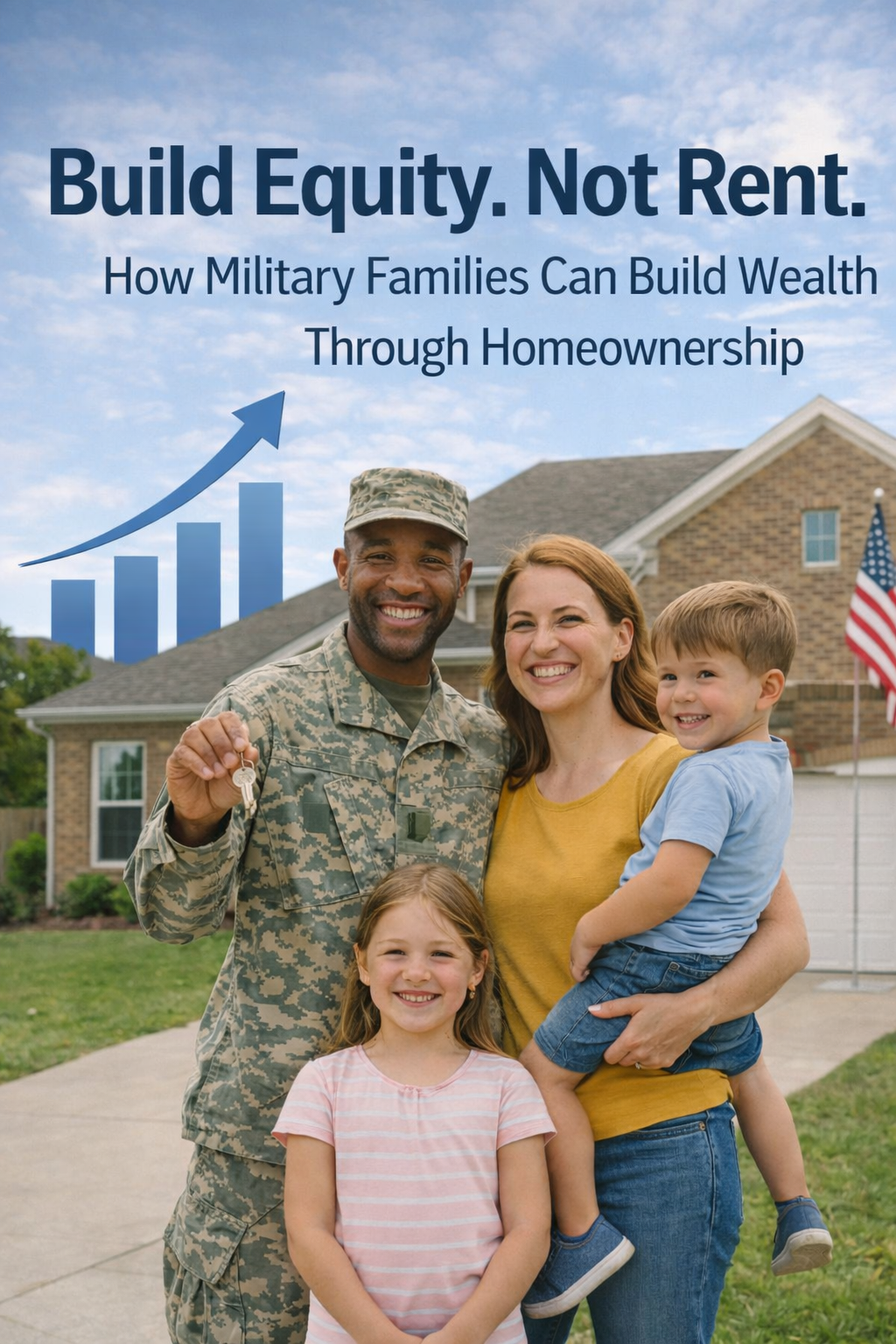

How Military Families Can Build Equity Instead of Paying Rent

Every PCS move comes with tough decisions — and one of the biggest is housing. Many military families default to renting because it feels flexible and safe. But over time, that choice often means thousands of dollars paid to a landlord with nothing to show for it.

The truth is, military families are in a unique position to build equity — even with frequent relocations. With VA loan benefits, strong Texas markets, and smart planning, you can turn housing into a long-term wealth strategy instead of an expense.

Here’s how.

What Does “Building Equity” Mean?

Equity is the difference between what your home is worth and what you owe on it.

You build equity by:

-

Paying down your mortgage balance

-

Benefiting from home appreciation

-

Making smart purchase decisions in strong markets

Renting builds zero equity — no matter how long you stay.

Why Military Families Are Perfectly Positioned to Build Equity

Military families often assume frequent moves prevent homeownership. In reality, VA loans and PCS flexibility make equity-building more achievable than most civilians realize.

Key advantages include:

-

VA loans with $0 down

-

No PMI (Private Mortgage Insurance)

-

Strong resale demand near military bases

-

Ability to sell or rent when you PCS (case-dependent)

1. Use Your VA Loan to Buy With Little or No Money Down

The biggest barrier to homeownership is usually the down payment — but VA loans remove that hurdle.

With a VA loan, you can:

-

Buy with $0 down

-

Preserve savings for emergencies or PCS costs

-

Enter the market sooner instead of waiting years

👉 This allows your BAH to work for you, not a landlord.

2. Buy in Military-Friendly Texas Markets

Texas is one of the best states for military homeownership thanks to affordability, population growth, and base stability.

Popular equity-friendly areas include:

-

San Antonio (JBSA)

-

Killeen / Fort Cavazos

-

El Paso / Fort Bliss

-

Corpus Christi / NAS Corpus Christi

Homes near bases often:

-

Appreciate steadily

-

Attract future military buyers

-

Rent easily if plans change

3. Let Your BAH Pay Down a Mortgage Instead of Rent

When you rent, your BAH disappears every month. When you buy, that same money:

-

Pays down your loan balance

-

Increases your ownership stake

-

Helps stabilize monthly housing costs

Over just 3–5 years, many military families build meaningful equity — even during shorter duty assignments.

4. Reuse Your VA Loan and Equity at the Next Duty Station

VA loan benefits aren’t one-and-done.

Depending on your situation, you can:

-

Sell your home and use the equity for the next purchase

-

Reuse your VA entitlement

-

Convert the home to a rental (with lender guidance)

This is how some military families slowly build a portfolio of properties over a career.

5. Use Tax Advantages to Strengthen Long-Term Gains

Texas offers several homeowner advantages:

-

No state income tax

-

Homestead exemption

-

Veteran and disabled veteran property tax exemptions

These benefits reduce long-term costs and increase net equity over time.

Renting vs. Equity-Building: A Simple Comparison

| Renting | Buying |

|---|---|

| Monthly payment disappears | Monthly payment builds equity |

| Rent increases | Fixed-rate mortgage stability |

| No asset | Sellable or rentable asset |

| No tax benefits | Potential tax advantages |

When Renting May Still Be the Right Choice

Buying isn’t always ideal. Renting may make sense if:

-

You’ll be stationed less than 12 months

-

You’re unsure of location or schools

-

Market conditions don’t align

That’s why every PCS move deserves a personalized rent-vs-buy analysis, not a one-size-fits-all answer.

Final Thoughts

Military families sacrifice enough — your housing shouldn’t work against you. With VA loan benefits, strategic buying, and the right guidance, you can turn PCS moves into opportunities to build equity instead of paying rent forever.

If you want help deciding whether buying makes sense for your next duty station — or how to build equity safely — I’d be honored to help you plan the smartest path forward. 🇺🇸🏡

Categories

Recent Posts